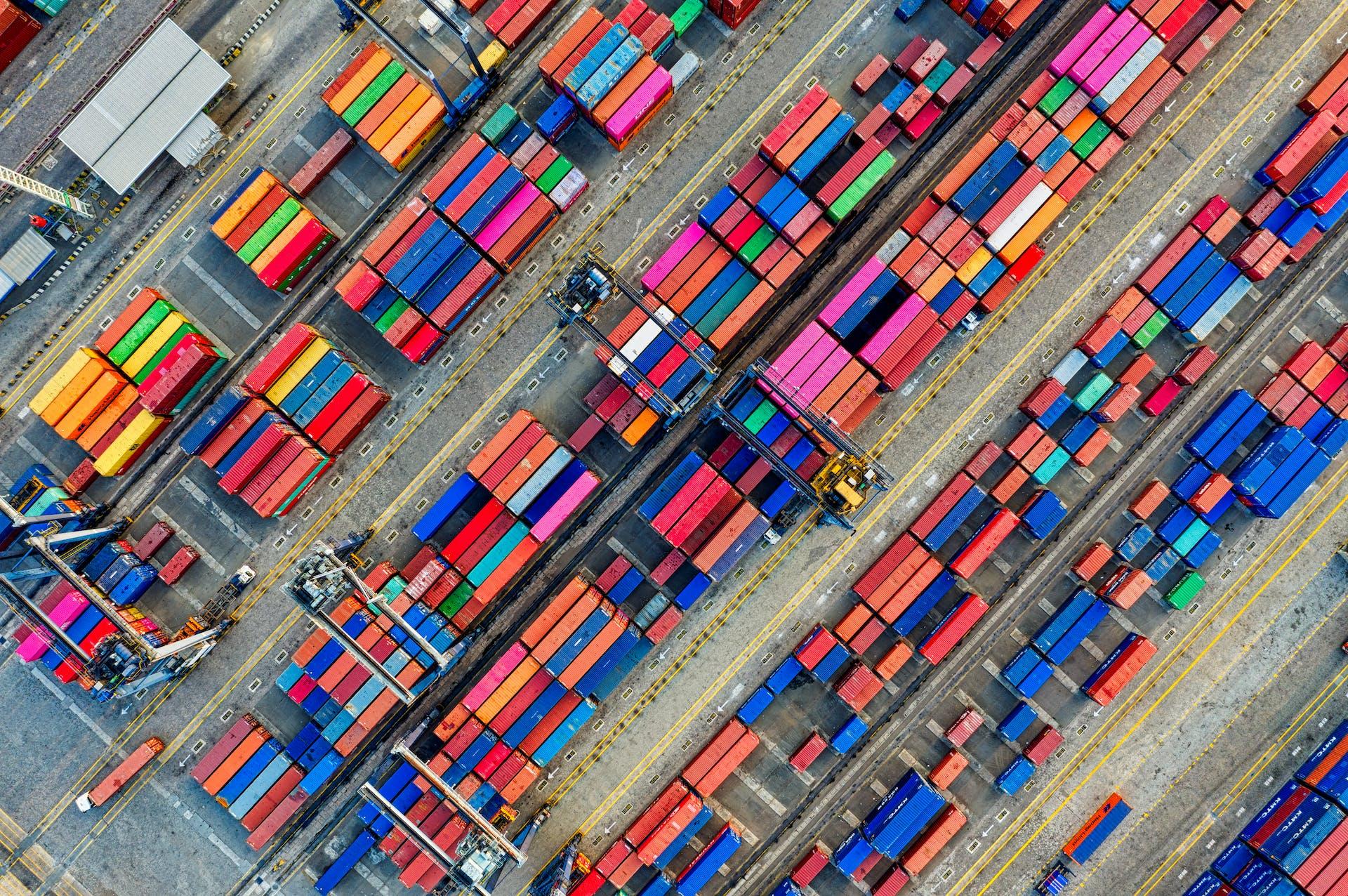

Understanding Trade-Based Money Laundering (TBML) might seem like unraveling a mystery, but we’ll make it easy. Imagine TBML as a hidden puzzle within international trade, where bad actors misuse the complexity to wash their ill-gotten gains. In simpler terms, TBML is a sneaky way of turning dirty money into seemingly clean money through trade deals.

Now, let’s dive into the basics to uncover why TBML is a big deal. It’s not just about complicated financial terms; it’s about how criminals use the vast world of global trade to hide their illegal activities. By exploring these basics together, we’ll shed light on why tackling TBML is crucial for keeping our financial systems secure. So, join us on this journey as we break down the complexity and decode the secrets behind Trade-Based Money Laundering.

1. Differentiating TBML from Traditional Money Laundering:

Where Money Hides

In traditional money laundering, criminals often deal with physical cash – like hiding large sums in secret places or laundering through financial institutions. In contrast, Trade-Based Money Laundering (TBML) is a clever way where illicit funds are concealed within international trade deals. It’s like hiding the money trail in the complex web of buying and selling goods across borders.

How Money Moves

Traditional money laundering may involve straightforward methods, like physically moving cash or using simple financial transactions. On the other hand, TBML is more intricate. Criminals exploit the vast and complex nature of global trade to make tracking and detection challenging. It’s akin to a sophisticated puzzle where they manipulate trade transactions, making it harder for authorities to follow the money trail.

Slow Steps or Swift Channels

Traditional money laundering can sometimes be slow and involve multiple steps, such as layering and integration to obscure the source of funds. In TBML, the process is swifter. Criminals can move large sums of money rapidly by using trade channels that, on the surface, appear legitimate. The ease and speed of TBML make it an attractive method for those seeking to quickly legitimize illicit gains through international trade.

2. Key Techniques Used in TBML:

Over-invoicing & Under-invoicing

Criminals engaging in Trade-Based Money Laundering (TBML) often manipulate the prices on invoices. Over-invoicing involves inflating the stated value of goods or services in the trade documentation, making it seem like they cost more than they actually do. Under-invoicing, on the other hand, is the opposite – deliberately declaring a lower value than the actual transaction amount.

How Criminals Play with Trade Financing

TBML involves exploiting financial tools within trade transactions. Criminals use these tools to legitimize their illegal funds, making it seem like they are engaging in legitimate trade activities. For instance, they may manipulate letters of credit, loans, or other financial instruments to create a façade of legitimate international commerce.

Misclassifying Goods to Hide Money

Criminals engaged in TBML may alter customs declarations to misclassify goods. By misrepresenting the nature or value of traded items, they aim to obscure the true value of the goods being exchanged. This creates a discrepancy between what is declared on official documents and the actual contents of the shipments.

Revealing the Secrets of Shell Companies

In TBML, criminals often create shell companies – entities that exist only on paper and have no real business operations. These entities act as fake trade partners, enabling criminals to hide their illicit activities behind a seemingly legitimate façade. Shell companies make it challenging for investigators to trace the actual beneficiaries of the funds.

3. Why Unchecked TBML Matters: Understanding the Impact

How TBML Affects the Economy

When people play money tricks through Trade-Based Money Laundering (TBML), it’s like someone cheating in a game. It makes the money game unfair and messes with how things should be. TBML doesn’t just stop at being unfair; it also makes the whole money world a bit wobbly. It can weaken how our money system works and make it less stable.

How TBML Affects National Safety

The money hidden in TBML often supports bad things like terrorism. This is a big worry because it can threaten our country’s safety. TBML is like a hidden danger because the money games criminals play can pose a threat to our national security. It’s important to stop these games to keep everyone safe.

How TBML Affects Society

TBML isn’t just about money tricks; it’s connected to serious problems like people being treated badly and drugs causing harm. It’s important to stop these games to keep people safe and happy.

4. Current Trends and Challenges in TBML Detection:

The tricks criminals use in Trade-Based Money Laundering (TBML) are getting fancier and more complicated. It’s like playing a game where the rules keep changing, and the players get smarter.

Police and rule-makers face big challenges trying to catch the TBML players. It’s like playing hide-and-seek with really good hiders, and finding them becomes a real puzzle.

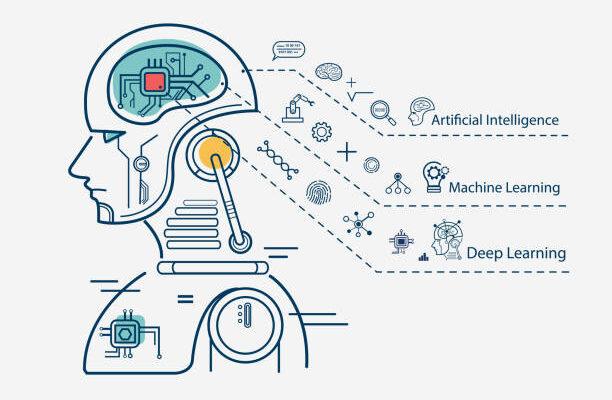

Cool inventions and smart ideas are helping to catch the tricky TBML games. Think of it like using high-tech tools to find hidden treasure; these innovations are like superheroes helping to stop the bad money games.

5. The Role of Businesses in Fighting TBML: How Companies Can Help

It’s important for companies to be smart about their money. By using strong Anti-Money Laundering (AML) practices, they’re like putting a lock on their money to keep it safe. Companies can stop the bad money tricks by doing their homework. It’s like checking things carefully to make sure everything is okay. This careful checking can scare away the bad guys.

Companies should work together with friends and experts. It’s like having friends around to help when things get tough. By teaming up with partners and institutions, they make a strong network to keep money safe for everyone.

6-The Vital Role of Trade Compliance Management:

Enter trade compliance management – the strategic approach and set of practices aimed at ensuring that businesses adhere to the regulations and standards governing international trade. In the context of TBML, effective trade compliance management becomes a crucial asset in the fight against financial exploitation.

How Trade Compliance Management Acts Against TBML:

Establishing Robust Policies: Trade compliance management involves setting up comprehensive policies that govern financial transactions within trade. These policies serve as a framework to detect and prevent potential TBML activities.

Continuous Monitoring: Through constant vigilance, trade compliance management ensures ongoing monitoring of trade transactions. This includes scrutinizing financial patterns, identifying anomalies, and raising red flags when irregularities are detected.

Integration of Technology: Trade compliance management often integrates advanced technologies, including specialized software tools. AI-driven, real-time trade compliance solutions play a pivotal role in automating the analysis of trade transactions, aiding in the identification of potential TBML activities.

Training and Awareness: Educating stakeholders involved in international trade about the nuances of TBML is a core aspect of trade compliance management. By fostering awareness, businesses can better identify and report suspicious activities.

Why it Matters:

The role of trade compliance management is instrumental in safeguarding the integrity of international trade. By actively preventing the exploitation of financial tools within trade transactions, it acts as a shield against criminals attempting to use trade channels for money laundering. Businesses, financial institutions, and regulatory bodies can leverage this technology to stay one step ahead in the ongoing battle against Trade-Based Money Laundering, ensuring a secure and transparent global trade environment.

Importance of Transaction Monitoring for TBML

January 31, 2024In today’s globalized economy, where transactions move across borders, the threat of money laundering is a growing concern for businesses and financial institutions alike. To combat this risk, Transaction Monitoring emerges as a powerful solution, ensuring the integrity and security...

What is a PEP? Implications for Politically Exposed Person (PEP)

January 30, 2024Who are PEPs: Politically Exposed Persons (PEPs) are individuals with significant roles in public offices or positions of authority, wielding substantial influence over government decisions, resources, and legislation. This includes heads of state, senior government officials, military leaders, judges, and...

Enhanced Due Diligence (EDD)

January 25, 2024Overview: Definition of EDD: Enhanced Due Diligence (EDD) is a comprehensive set of measures applied in situations that signal a higher risk of money laundering and terrorist financing. It goes beyond standard Customer Due Diligence (CDD) procedures and involve obtaining...

Navigating KYC and AML Compliance: A Comprehensive Guide

January 23, 2024The financial industry is experiencing a transformative phase with the integration of machine learning (ML) and artificial intelligence (AI) in the Regulatory Technology (RegTech) sector. This collaboration is reshaping Anti-Money Laundering (AML) and Know Your Customer (KYC) compliance, providing a...

Machine Learning In Trade based Money Laundering (TBML): An Overview For Compliance Teams

January 20, 2024The financial landscape is undergoing a significant transformation with the integration of machine learning (ML) and artificial intelligence (AI) into the Regulatory Technology (RegTech) sector. This collaboration is reshaping how trade, compliance, business and risk teams’ approach TBML compliance. Let’s...

What are Sanctions, Sanctions List & Sanctions Screening? A Complete Guide

January 19, 2024What are Sanctions: Sanctions are financial and trade-related penalties imposed by one country or a group of countries on another entity, be it a country, company, or individual. The primary purpose is to exert economic, trade, political, and diplomatic pressure...

Decoding Trade-Based Money Laundering: A Simple Guide

January 16, 2024Understanding Trade-Based Money Laundering (TBML) might seem like unraveling a mystery, but we’ll make it easy. Imagine TBML as a hidden puzzle within international trade, where bad actors misuse the complexity to wash their ill-gotten gains. In simpler terms, TBML...