Smart Trade AML

An Intelligent Choice

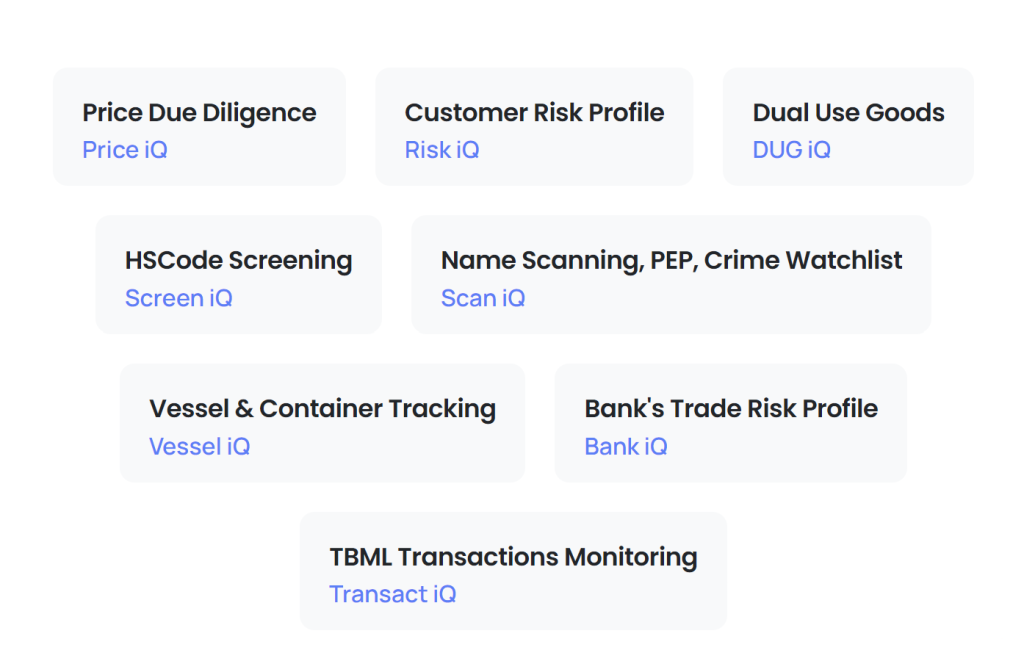

Trade iQ: A cutting-edge, AI-driven modular solution tailored for trade finance compliance, offering real-time unified transaction insights across Trade, Compliance, Business, and Risk teams. Expertly designed to address trade-based money laundering and terrorist financing risks, ensuring adherence to regulatory frameworks, and fostering a secure financial environment.

Expert-led, tailored consulting services to combat financial crimes.

Trusted by Leading Institutions

Technologies We Use

Empowering Solutions with Advanced Technologies

Artificial Intelligence

Computer Vision

Big Data

Data Science

BI Intelligence

Cloud Engineering

Trade iQ

Revolutionizing TBML/CFT compliance with AI for risk mitigation, automation & unparalleled insights across departments

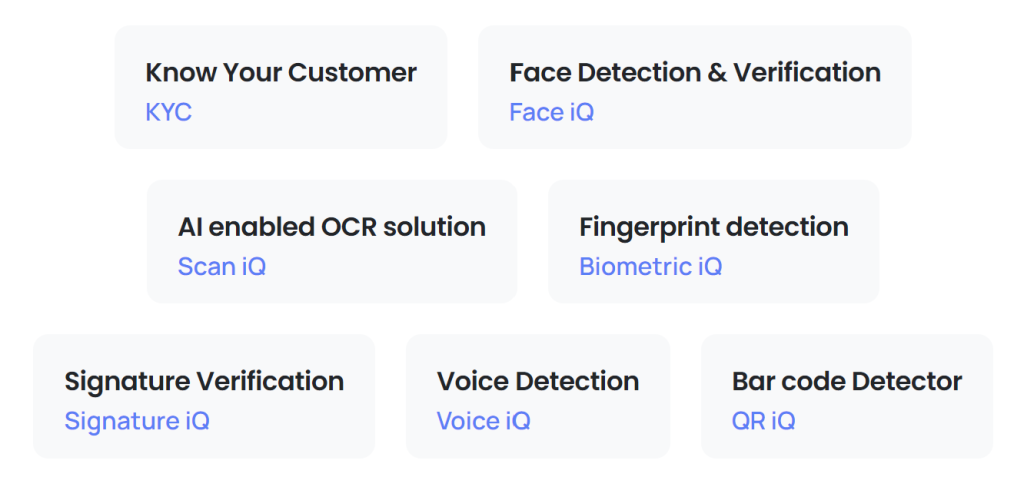

Identity X

Reinventing digital identity proofing for secure, compliant banking experiences amid digital transformation

ICM

Designed to tackle the challenges of customer service by unifying various communication channels on a single platform.

Your RegTech Partner

AKS iQ is a leading RegTech company specializing in AI solutions for the banking industry.

Rules Don't Define Risk

Behavior Does

Partner for Paperless

TBML Regulatory Compliance

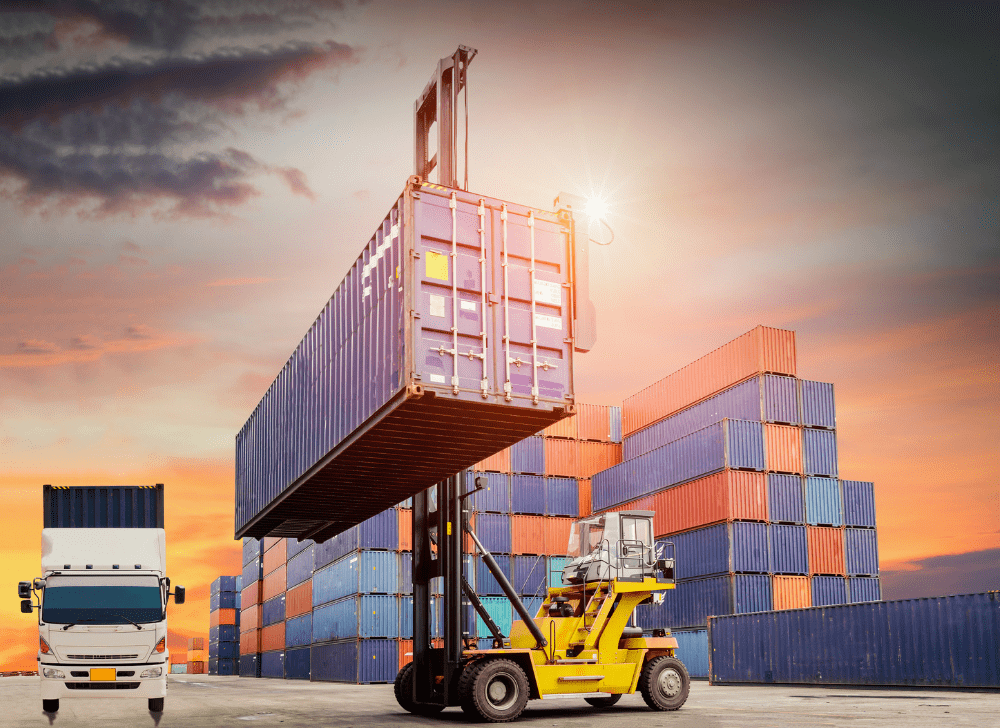

Trade-based money laundering (TBML) poses significant risks to banks, impacting their reputation, regulatory compliance, and financial performance. Involvement in TBML can lead to loss of trust, hefty fines, legal consequences, and operational challenges. Additionally, TBML can strain correspondent banking relationships, increase operational costs, and result in direct financial losses. Banks must navigate these complexities to protect their integrity and maintain a strong presence in the global financial system.

Trade iQ - Smart Trade AML

An Intelligent Choice

Trade iQ™, an AI-enabled TBML solution, empowers banks to execute import and export transactions in a highly automated, paperless environment. Streamline AML checks, mitigate compliance risks, improve operational efficiency, and facilitate data-driven decision-making across departments, resulting in elevated service standards, enhanced customer experiences, and reduced risk levels.

Statistics

Banking with Confidence: Advanced Digital Identity Proofing

Banks worldwide are undergoing digital transformation, with customers increasingly opting for the convenience of secure digital channels to transact. The volume of financial transactions through mobile and web applications is growing exponentially each year, exposing banks to heightened fraud risks. Ensuring customers are who they claim to be is essential for protecting them and your organization from fraud while maintaining compliance.

Identity X

Safeguard Against Identity Theft, Impersonation, and Account Takeovers

As the world embraces digital transformation, banks must prioritize customer identity verification to combat fraud and ensure compliance while delivering a seamless, secure experience.

Customers Digital Experience

The constantly evolving customer service landscape demands seamless integration of various communication channels. ICM bridges the gap between organizations and customers by providing a consistent omnichannel experience across multiple chat communication channels. The Intelligent Communication Manager Gadget integrates Call Center Applications, Bots, Chat Applets, and CRM systems on a single platform, streamlining customer interactions and boosting contact center efficiency.

ICM – AI Hybrid Chat Solution

ICM (Intelligent Communications Manager) is an AI hybrid chat solution that integrates multiple chat platforms, including web chat, Facebook, WhatsApp, SMS gateway, and Mobile App. It connects preferred AI chatbot, such as Google Dialogflow, IBM Watson, or Microsoft Azure BOT, to chosen front-end system, like a CRM (Salesforce, Microsoft Dynamics, SAP, or Oracle) or Cisco Contact Center Finesse

Key Banking Customers

Client Perspectives: Stories of Impact

Advanced cameras combined with a large display and fast performance.

"This key partnership will enable the Bank to enhance the management of its existing risk portfolio, mitigate operational and compliance issues and facilitate data-driven decision-making across key departments."

Shazad Dada

"We worked under the guidance of the central bank to come up with this unique solution which is going to revolutionize the way we are going to look at the trade based initiatives."

Majid Aziz

"For Faysal Bank, technology as an enabler is a key focus area. We have invested significantly in this area and are now starting to reap the benefits."

Syed M. Fraz Zaidi

"AKS iQ is our partner in solving most unique and complex technological problems. This partnership will enable us in designing and strengthening our trade based anti-money laundering system."