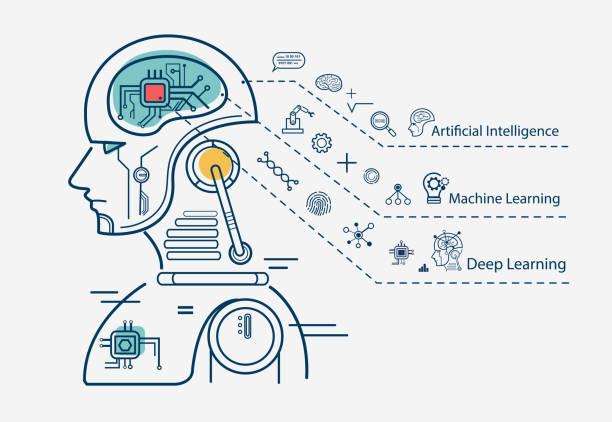

The financial landscape is undergoing a significant transformation with the integration of machine learning (ML) and artificial intelligence (AI) into the Regulatory Technology (RegTech) sector. This collaboration is reshaping how trade, compliance, business and risk teams’ approach TBML compliance. Let’s dive into the core elements, advantages, and challenges of this technological revolution.

Technological Trends:

Financial institutions (FIs) are increasingly using machine learning (ML) and artificial intelligence (AI) to strengthen their efforts against trade-based Anti-Money Laundering (AML). This continuing trend is expected to enhance current projects and discover new ways these technologies can be applied, marking a significant advancement for the industry.

Big Data Challenges in Trade AML Compliance:

FIs deal not only with regular data but also navigate substantial amounts of unstructured data, commonly known as “big data.” Dealing with this huge data surge needs advanced tools, and machine learning becomes a crucial solution for various analytical needs.

Deep Learning: Advanced AI in the Fight Against Trade AML:

Deep learning is advanced ML type. It uses networks inspired by the human brain, learning from big datasets on its own. Complex networks can learn by themselves from huge amounts of data. They are especially good at dealing with data that comes in large amounts, is often updated, and might not be of the best quality.

Role of Machine Learning in Trade AML Predictions

A pivotal aspect of ML is a crucial system for predicting alerts. When the ML model identifies a suspicious activity pattern, it not only triggers an alert but also gives a detailed explanation of the prediction. This user-friendly approach helps business users in understanding and trusting the system-generated alerts. Furthermore, the trade based AML Solution continually refines its understanding by creating intelligent rules, gradually reducing the number of false positives.

Streamlining TBML Operations with Machine Learning

Machine learning in Trade-Based Money Laundering (TBML) aims to enhance efficiency across various framework elements which includes transaction monitoring, risk assessments, and Know-Your-Customer (KYC) processes. Through a combination of supervised and unsupervised machine learning techniques, it rapidly and precisely identifies suspicious activities. The solution smartly organizes alerts into different risk levels – low, medium, and high – making the process of prioritizing and addressing urgent threats more streamlined.

Recapping ML Benefits in trade AML:

Machine learning unfolds a myriad of benefits in AML:

Early Detection: Swift identification of Trade-Based Money Laundering (TBML) attempts.

Greater Efficiency: Automation of tedious tasks, enabling analysts to focus on complex investigations.

Precision Targeting: Prioritization of alerts based on risk scores, directing resources effectively.

Adaptability: Continuous learning and adaptation to stay ahead of evolving threats.

Final Thoughts:

The rapid changes in the financial sector see the use of ML and AI, especially in Regulatory Technology (RegTech), presenting challenges and notable advantages in predicting risks for management and compliance. Collaborative efforts among financial institutions, regulators, and tech companies are crucial as these technologies develop to fully realize their potential in the financial industry.