Paperless. Collaborative. Agile. Compliant

Smart Trade AML

Trade iQ

An Intelligence Choice

Discover Trade iQ™ - The AI-driven, real-time solution that redefines trade finance compliance. Unify transaction views across business units, unlock unparalleled insights, and empower your Trade, Compliance, Business, and Risk teams to manage risks and adhere to regulatory frameworks effectively.

Experience efficiency, protection, and enhanced customer experiences with our revolutionary Anti-Money Laundering Platform.

Streamlining AML/CFT Compliance in Trade Finance

Trade iQ™, an AI-enabled TBML solution, empowers banks to execute import and export transactions in a highly automated, paperless environment. Streamline AML checks, mitigate compliance risks, improve operational efficiency, and facilitate data-driven decision-making across departments, resulting in elevated service standards, enhanced customer experiences, and reduced risk levels.

ONE-STOP FULLY AUTOMATED

Trade iQ™

Smart Trade AML: An Intelligent Choice

Paperless. Collaborative. Agile. Compliant

Comprehensive, Fully Automated Trade Finance AML Solution

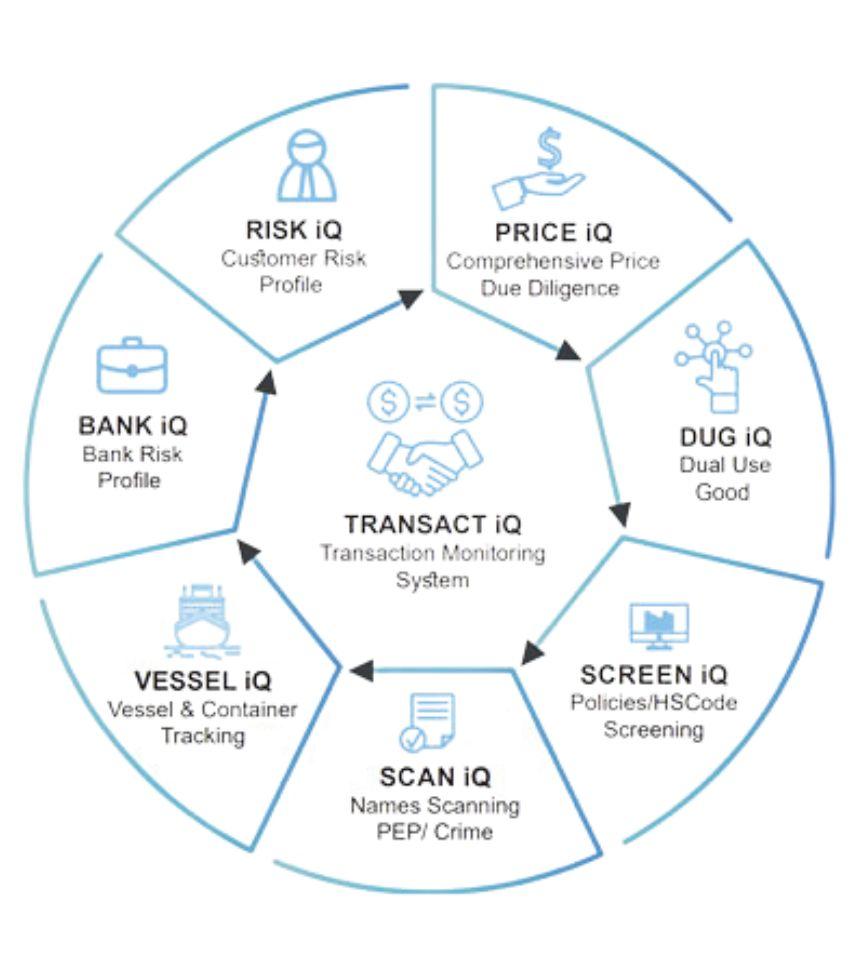

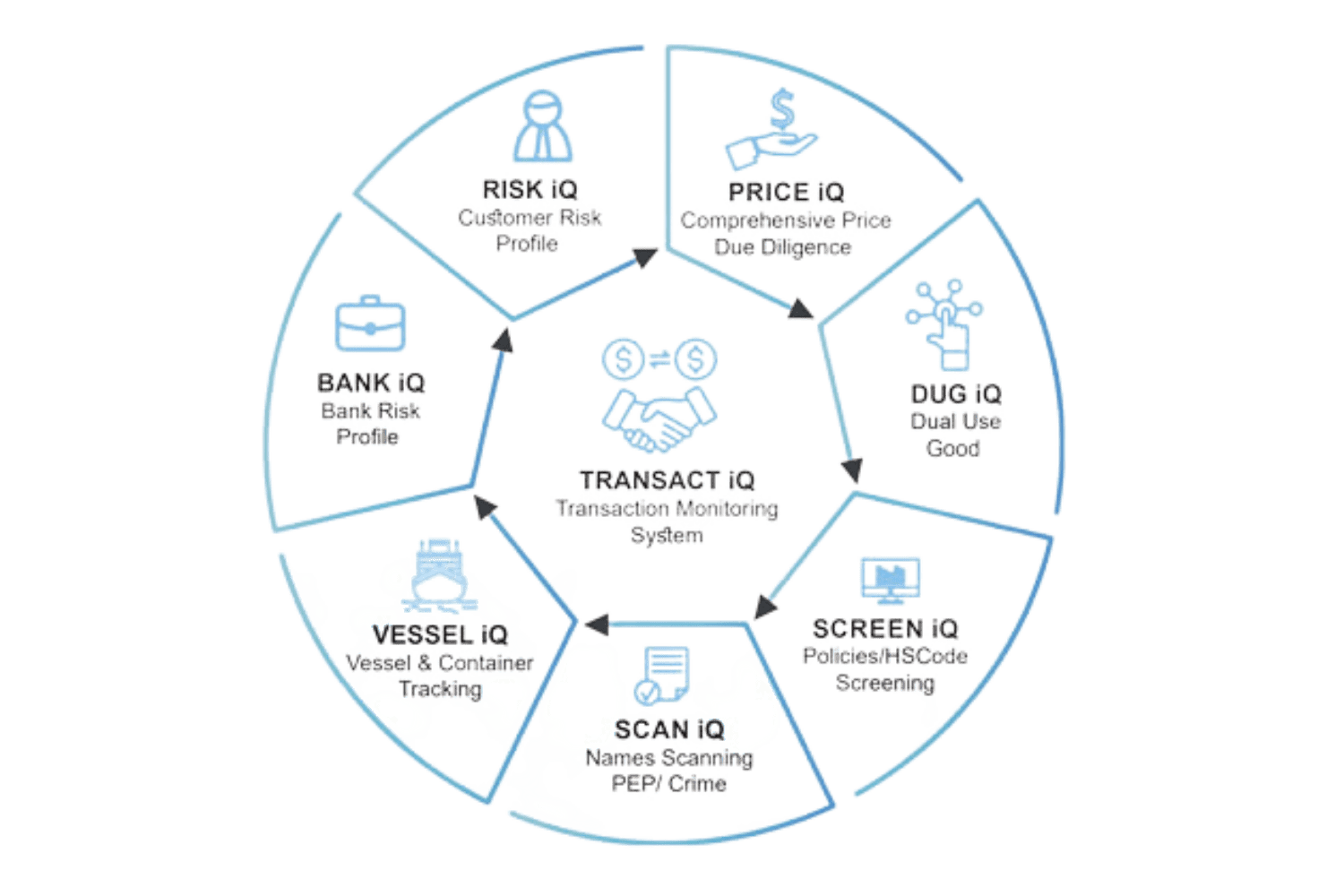

Trade iQ™ provides an end-to-end solution for TBML checks on transactions, covering a complete journey across departments.

The comprehensive suite includes price due diligence, government and bank policy checks, dual-use goods checks, sanctions screening, PEP checks, crime watchlist checks, vessel and container tracking, customer risk profiling or KYC, and bank trade risk profiling.

Trade iQ™ features one of its kind AI-based real-time transaction monitoring and seamless integration options with banking systems.

Paperless TBML Compliance

Unified Transaction View

Breaking Silos and Improving Collaboration

Trade iQ offers a unified transaction view for all stakeholders, improving collaboration and streamlining outreach. It provides robust and credible indicators for the bank to make intelligent and informed decisions around every transaction.

Trade iQ Streamlines Bank Workflow

Trusted by Leading Institutions

ONE-STOP FULLY AUTOMATED

Trade iQ™

Revolutionizing Trade Finance Compliance with AI-Powered Insights

Trade iQ™, an AI-driven solution, transforms trade finance compliance by empowering banks to tackle TBML risks and terrorist financing effectively. With a comprehensive, fully automated platform, financial institutions can confidently navigate the evolving regulatory landscape while maintaining a secure, paperless, and sustainable future.

RULES Don’t Define Risk, BEHAVIOR Does

Adopt Trade iQ™, the intelligent choice for trade finance compliance, and foster a transparent, responsible, and resilient financial sector.

Confidently navigate the evolving regulatory landscape, maintaining a secure, paperless, and sustainable future

Paperless. Collaborative. Agile. Compliant

Regulatory Complaint

Paperless

Fully Automated

Efficient

Address Every Compliance Need

Risk iQ

Trade Customers' Risk Profile

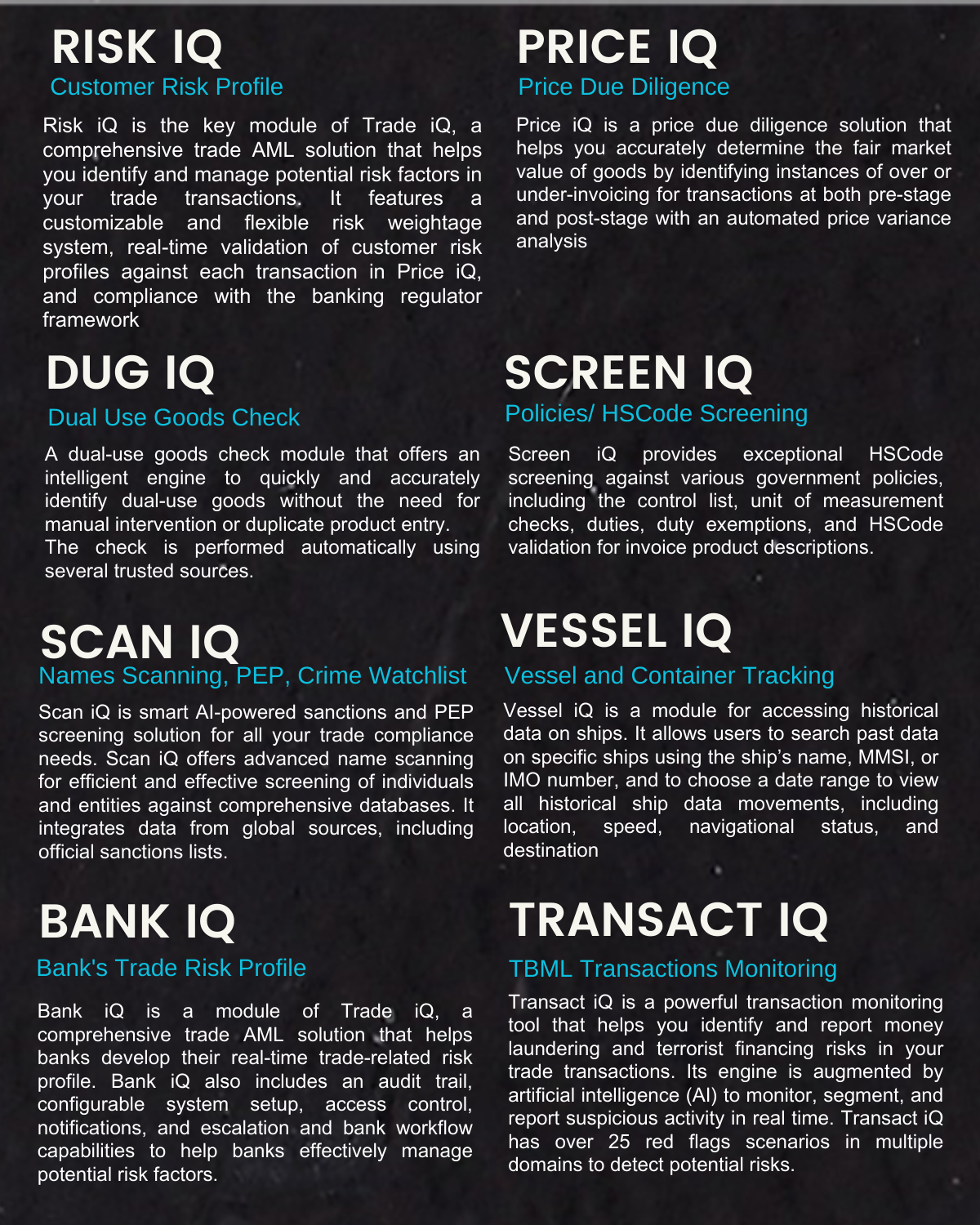

Risk iQ is the key module of Trade iQ, a comprehensive trade AML solution that helps you identify and manage potential risk factors in your trade transactions. It features a customizable and flexible risk weightage system, real-time validation of customer risk profiles against each transaction in Price iQ, and compliance with the banking regulator framework. The customer risk profile includes but is not limited to detailed information about the goods being traded, the buyers and sellers involved, and other parties involved in the transaction. It also includes general trade information and customer overdue verification from concerned banks. Risk iQ maintains an audit trail, has a configurable system setup, offers access control , escalation and bank workflow capabilities to help you manage potential risk factors effectively.

Price iQ

Price Due Diligence

Price iQ™ is a price due diligence solution that helps you accurately determine the fair market value of goods by identifying instances of over or under-invoicing for transactions at both pre-stage and post-stage with an automated price variance analysis. With access to unmatched pricing data sources in the market, Price iQ can significantly reduce the processing time of transactions for price due diligence from 30 minutes down to just 3 minutes.

DUG iQ

Dual Use Goods

A dual-use goods check module that offers an intelligent engine to quickly and accurately identify dual-use goods without the need for manual intervention or duplicate product entry. The check is performed automatically using several trusted sources. In addition, DUG iQ is customizable and can be configured to check against bank-provided lists as well.

Scan iQ

Names Scanning, PEP, Crime Watchlist

Scan iQ is smart AI-powered sanctions and PEP screening solution for all your trade compliance needs. Scan iQ offers advanced name scanning for efficient and effective screening of individuals and entities against comprehensive databases. It integrates data from global sources, including official sanctions lists and information on politically exposed persons and entities of criminal interest.

Vessel iQ

Vessel and Container Tracking

Vessel iQ is a module for accessing historical data on ships. It allows users to search past data on specific ships using the ship’s name, MMSI, or IMO number, and to choose a date range to view all historical ship data movements, including location, speed, navigational status, and destination. Vessel iQ also provides access to historical location data on vessel traffic in specific zones, ports, or other areas along with the sanctions checks, allowing users to validate vessel data during selected time periods. This data is stored based on live ship data. Vessel iQ offers one of the largest ships databases in the market, containing over 750,000 vessels. The database includes detailed information about ships, their ownership and operators with sanctions screening, and more

In addition, Vessel iQ provides access to one of the largest maritime port databases globally, with over 21,000 ports and detailed information on location, code, country, type, area location, and more.

Bank iQ

Bank's Trade Risk Profile

Bank iQ is a module of Trade iQ, a comprehensive trade AML solution that helps banks develop their real-time trade-related risk profile. The risk profile is calculated using a customizable and flexible risk weightage system based on factors such as the weighted average risk rating of the bank’s trade portfolios, the jurisdictions and industries in which the bank conducts trade transactions, red flags and STRs reported, trade customers subjected to enhanced due diligence, and the risks associated with various trade-related products and channels offered by the bank.

Transact iQ

TBML Transactions Monitoring

Transact iQ is a powerful real-time transaction monitoring tool that helps you identify and report money laundering and terrorist financing risks in your trade transactions. Its engine is augmented by artificial intelligence (AI) to monitor, segment, and report suspicious activity in real-time. Transact iQ has over 25 red flags scenarios in multiple domains to detect potential risks. Its AI engine is regularly updated to identify new types of money laundering and terrorist financing risks.

It provides a real-time visualization engine that shows you all trade activities related to money laundering and terrorist financing in a single window and offers a comprehensive reporting engine with a complete audit trail of transactions.

TBML Consulting Services

AKS iQ is a leading provider of consulting services to regulators and banks around the world. Our team of experts has a wealth of knowledge and experience in the field of technology solutions for combating trade-based money laundering and counter-financing terrorism. We understand the complex and constantly evolving nature of these financial crimes and have developed a range of innovative solutions to help regulators and banks stay ahead of the curve.

Our consulting services are tailored to the specific needs of each client, and we work closely with them to understand their unique challenges and objectives. Whether you are a regulator looking to implement advanced detection systems or a bank seeking to strengthen your compliance processes, we have the expertise and resources to help you succeed.